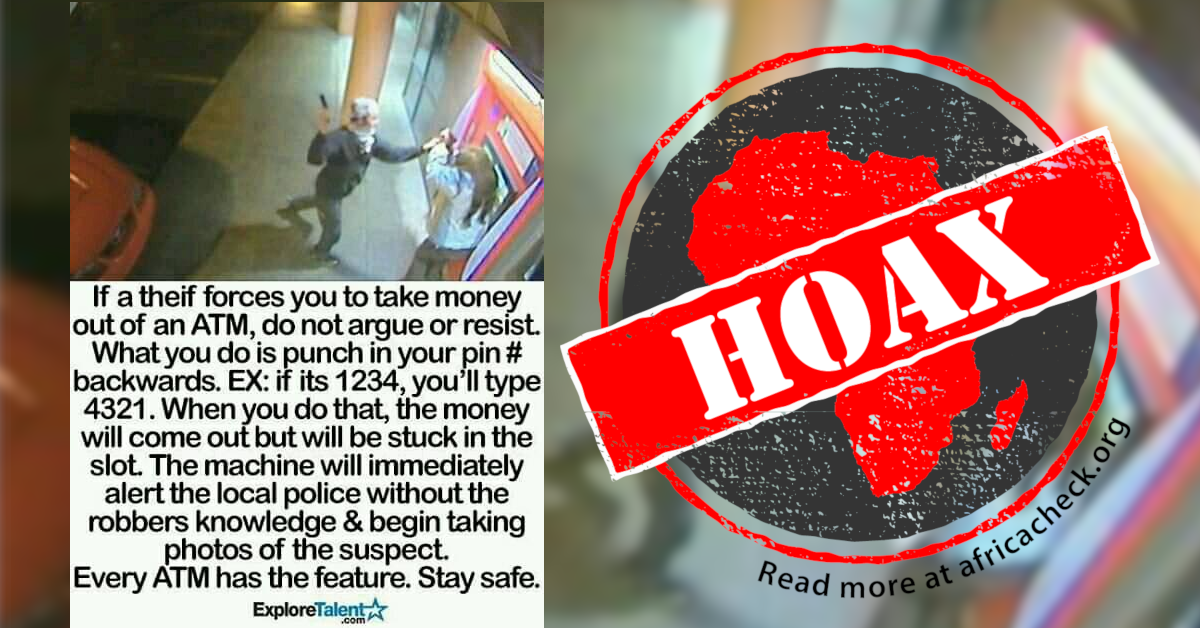

A potentially life-threatening Facebook post says that if you’re threatened and forced to withdraw cash at an ATM, all you have to do is enter your PIN number backwards and the police will be alerted.

It reads: "If a thief forces you to take money out of an ATM, do not argue or resist. What you do is punch in your pin # backwards. EX: if its 1234, you'll type 4321. When you do that the money will come out but will be stuck in the slot. The machine will immediately alert the local police without the robber’s knowledge & begin taking photos of the suspect. Every ATM has the feature. Stay safe.” The post was published on 1 May 2019.

Is there an emergency PIN technology that allows a besieged ATM user to quietly activate an alarm that discreetly alerts the police? No – and if it angers the mugger, you could be harmed.

“That is not factual,” Dr Habil Olaka, the chief executive of the Kenya Bankers Association told Africa Check. He said the reverse-PIN entry is a hoax that has been doing rounds online for years.

If you’re attacked by an armed robber and forced to withdraw money from the ATM, the best option is to cooperate, Olaka said.

Fidelis Muia, the association’s director of technical services, said ATMs don’t even recognise correct PINs – the bank’s computer does that.

“There is no truth to that story,” he told us.

“As designed, the ATM machine collects a card number, the PIN the customer entered on inserting said card, and sends that information to the issuing bank. It is the issuing bank that uses an algorithm to confirm the PIN and the associated card match, not the ATM machine,” he said.

“If the algorithm gives a correct check, the issuing bank system gives an authorisation message to the ATM to dispense cash, otherwise it sends a decline message.”

Olaka said all ATMs in Kenya are fitted with cameras, “but cameras come in after the fact in terms of being able to trace and apprehend the person. Cameras are not preventative.”

The Australian Bankers Association also says the advice is false.

“Claiming that entering your PIN in reverse will summon police to an ATM and the withdrawal will be successful, is totally false,” says an association factsheet released in 2007 and updated in 2011.

“The PIN has only one function - to allow the customer to access their account – and it must be entered correctly each time and kept confidential.”

Back in 2007 fact-checking site Snopes exhaustively looked into the claim and found it to be false. Snopes says it first appeared in 2006.

It is an old rumour that was called out on the Don’t Trust Rumours Facebook page in September 2014, and again by a Facebook user in October 2018.

But the claim has circulated in Kenya, such as in this 2013 Facebook post and this March 2017 post in a Facebook group with nearly 140,000 followers.

Like many false rumours, it has some basis in fact.

According to a 2010 report of the Federal Trade Commission, a US agency consumer protection agency, the “reverse PIN” technology is “an urban legend” arising from a proposal for “emergency PIN technologies”. The “emergency-PIN technologies have never been deployed at any ATMs”.

“An ATM reverse-PIN system called ‘SafetyPIN’ was invented by Joseph Zingher,” the report say. “According to Mr Zingher, SafetyPIN is a simple computer code “that would recognise reversed, inverted, or otherwise altered [PINs] as a distress signal, and [instruct] the teller machine to call the cops.”

The electronic message relayed to an alarm company dispatcher would contain “the card holder’s name, identifier and location”.

It was never implemented, with ATM manufacturers cited in the report saying as much. The FTC report also says that if a bank customer is accosted after an ATM withdrawal, they’d have no way of using the hoax distress signal.

And the danger is real.

“It could potentially be dangerous given that it provides plain false information to people who would be in extremely dangerous and volatile situations,” says an article on That Nonsense, a website dedicated to calling out online nonsense.

Politifact has also checked the claim and rated it false. A 2015 blog published on the website of Kaspersky, the provider of internet security solutions, labelled the “reverse PIN” advice as “myth” and ruled that it was “fiction”. – Alphonce Shiundu (30/05/2019)

It reads: "If a thief forces you to take money out of an ATM, do not argue or resist. What you do is punch in your pin # backwards. EX: if its 1234, you'll type 4321. When you do that the money will come out but will be stuck in the slot. The machine will immediately alert the local police without the robber’s knowledge & begin taking photos of the suspect. Every ATM has the feature. Stay safe.” The post was published on 1 May 2019.

Is there an emergency PIN technology that allows a besieged ATM user to quietly activate an alarm that discreetly alerts the police? No – and if it angers the mugger, you could be harmed.

“That is not factual,” Dr Habil Olaka, the chief executive of the Kenya Bankers Association told Africa Check. He said the reverse-PIN entry is a hoax that has been doing rounds online for years.

If you’re attacked by an armed robber and forced to withdraw money from the ATM, the best option is to cooperate, Olaka said.

The PIN has only one function

Fidelis Muia, the association’s director of technical services, said ATMs don’t even recognise correct PINs – the bank’s computer does that.

“There is no truth to that story,” he told us.

“As designed, the ATM machine collects a card number, the PIN the customer entered on inserting said card, and sends that information to the issuing bank. It is the issuing bank that uses an algorithm to confirm the PIN and the associated card match, not the ATM machine,” he said.

“If the algorithm gives a correct check, the issuing bank system gives an authorisation message to the ATM to dispense cash, otherwise it sends a decline message.”

Olaka said all ATMs in Kenya are fitted with cameras, “but cameras come in after the fact in terms of being able to trace and apprehend the person. Cameras are not preventative.”

The Australian Bankers Association also says the advice is false.

“Claiming that entering your PIN in reverse will summon police to an ATM and the withdrawal will be successful, is totally false,” says an association factsheet released in 2007 and updated in 2011.

“The PIN has only one function - to allow the customer to access their account – and it must be entered correctly each time and kept confidential.”

Old rumour from 2006

Back in 2007 fact-checking site Snopes exhaustively looked into the claim and found it to be false. Snopes says it first appeared in 2006.

It is an old rumour that was called out on the Don’t Trust Rumours Facebook page in September 2014, and again by a Facebook user in October 2018.

But the claim has circulated in Kenya, such as in this 2013 Facebook post and this March 2017 post in a Facebook group with nearly 140,000 followers.

Reverse PIN system proposed, but never implemented

Like many false rumours, it has some basis in fact.

According to a 2010 report of the Federal Trade Commission, a US agency consumer protection agency, the “reverse PIN” technology is “an urban legend” arising from a proposal for “emergency PIN technologies”. The “emergency-PIN technologies have never been deployed at any ATMs”.

“An ATM reverse-PIN system called ‘SafetyPIN’ was invented by Joseph Zingher,” the report say. “According to Mr Zingher, SafetyPIN is a simple computer code “that would recognise reversed, inverted, or otherwise altered [PINs] as a distress signal, and [instruct] the teller machine to call the cops.”

The electronic message relayed to an alarm company dispatcher would contain “the card holder’s name, identifier and location”.

It was never implemented, with ATM manufacturers cited in the report saying as much. The FTC report also says that if a bank customer is accosted after an ATM withdrawal, they’d have no way of using the hoax distress signal.

‘Dangerous and volatile situations’

And the danger is real.

“It could potentially be dangerous given that it provides plain false information to people who would be in extremely dangerous and volatile situations,” says an article on That Nonsense, a website dedicated to calling out online nonsense.

Politifact has also checked the claim and rated it false. A 2015 blog published on the website of Kaspersky, the provider of internet security solutions, labelled the “reverse PIN” advice as “myth” and ruled that it was “fiction”. – Alphonce Shiundu (30/05/2019)

Republish our content for free

For publishers: what to do if your post is rated false

A fact-checker has rated your Facebook or Instagram post as “false”, “altered”, “partly false” or “missing context”. This could have serious consequences. What do you do?

Click on our guide for the steps you should follow.

Publishers guideAfrica Check teams up with Facebook

Africa Check is a partner in Meta's third-party fact-checking programme to help stop the spread of false information on social media.

The content we rate as “false” will be downgraded on Facebook and Instagram. This means fewer people will see it.

You can also help identify false information on Facebook. This guide explains how.

Add new comment