IN SHORT: Borrowers have been flocking to Kenya’s low-interest “hustler fund”. But a claim on social media that people could be jailed for not repaying the loans on time is not supported by any evidence.

A message going viral on Facebook since late 30 November 2022 claims that people who don’t make payment on loans from Kenya’s new “hustler fund” within 14 days will be imprisoned.

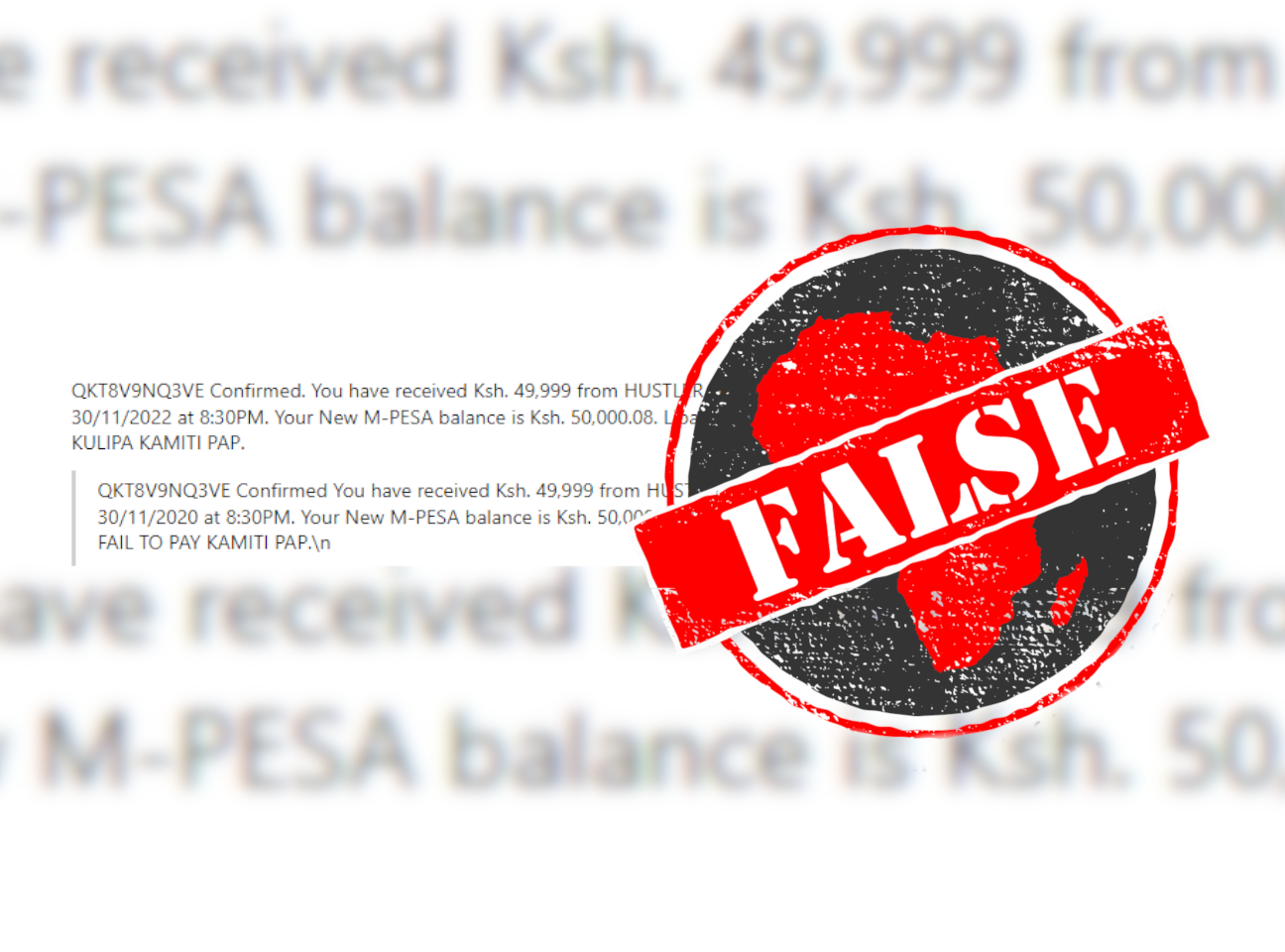

“QKT8V9NQ3VE Confirmed. You have received Ksh. 49,999 from HUSTLER FUND KITTY 00124 on 30/11/2022 at 8:30PM. Your New M-PESA balance is Ksh. 50,000.08,” it reads.

It then adds in Kiswahili: “Lipa kabla siku 14. KOSA KULIPA KAMITI PAP.” This means the borrower has 14 days to repay, or be immediately sent to Kenya’s much-feared Kamiti maximum security prison.

The hustler fund is the name given to the new KSh50 billion state-backed scheme to provide cheap loans, including to small businesses, at an initial interest of 8%. It was launched on 30 November by president William Ruto.

It was one of the campaign promises of the Kenya Kwanza coalition in the run-up to Kenya’s August elections. Ruto led the coalition and won the race for president. He has long branded himself as a man of the people who supports “hustlers” – people from humble backgrounds who hustle for a living.

Within minutes of the fund’s launch, millions of Kenyans were able to register and apply for loans on its website. The loans are available on mobile money platforms such as M-Pesa.

But will people who fail to repay on time be sent to prison?

Defaulters face high interest rate, account freeze

Simon Chelugui, the minister whose docket includes small businesses, has dismissed claims that defaulters would be heavily fined, and by extension, otherwise heavily punished.

“There is no such thing. The penalties in the regulations target fund officials who may embezzle or misappropriate the funds,” he said.

But defaulters will pay a higher rate of interest of 9.5% from the 15th day. And if they default for more than 30 days the interest will continue to accrue, they will lose their existing credit score and eventually have their account frozen. Other loan recovery methods will be used, including having compulsory savings under the fund seized.

And the threat of jail would have been widely reported by Kenya’s news media, which have covered the fund extensively. But there have been no headlines about the threat.

The message is false.

Republish our content for free

For publishers: what to do if your post is rated false

A fact-checker has rated your Facebook or Instagram post as “false”, “altered”, “partly false” or “missing context”. This could have serious consequences. What do you do?

Click on our guide for the steps you should follow.

Publishers guideAfrica Check teams up with Facebook

Africa Check is a partner in Meta's third-party fact-checking programme to help stop the spread of false information on social media.

The content we rate as “false” will be downgraded on Facebook and Instagram. This means fewer people will see it.

You can also help identify false information on Facebook. This guide explains how.

Add new comment