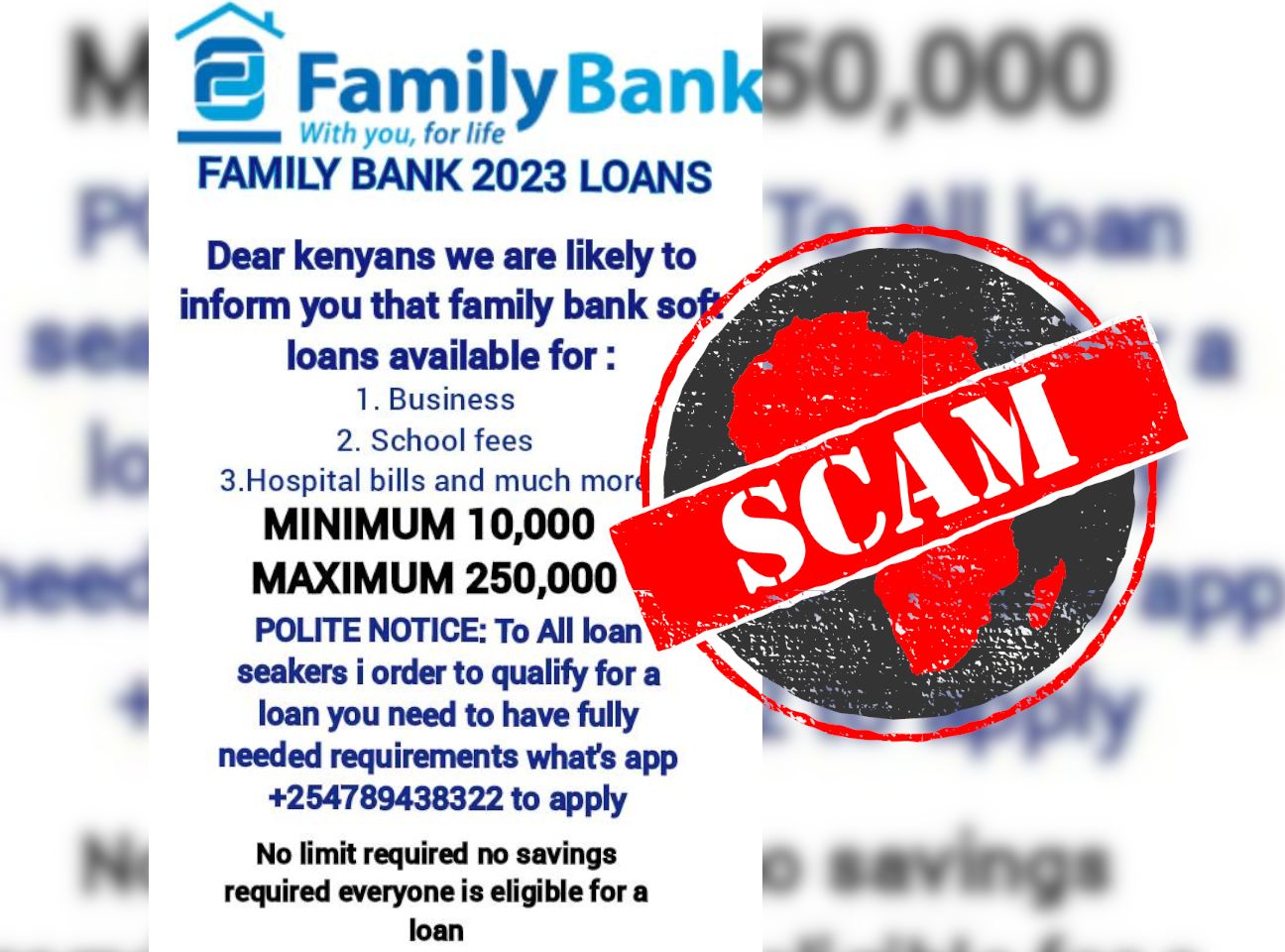

IN SHORT: The loan terms are attractive. But the offer isn’t real – and it’s probably a scam.

A graphic announcing soft loans supposedly from Kenya’s Family Bank has been posted on Facebook.

The loan amounts range from KSh10,000 to KSh250,000 (about US$80 to $2,000).

“FAMILY BANK 2023 LOANS Dear Kenyans we are likely to inform you that family bank soft loans available for 1. Business 2. School fees 3. Hospital bills and much more MINIMUM 10,000 MAXIMUM 250,000,” the graphic reads.”

It continues. “POLITE NOTICE: To loan seakers I order to qualify for a loan you need to have fully needed f requirements what’s app +254789438322 to apply No limit required no savings required everyone is eligible for a loan.”

Family Bank is a commercial bank in Kenya regulated by the central bank of Kenya.

The graphic has the bank’s branding. But are the loans legit?

Loan application – on WhatsApp?

The announcement is riddled with grammatical errors, which would be unlikely from a credible bank.

Another red flag is the requirement to apply via a WhatsApp number – not to mention that “everyone” who does is likely to get a loan.

And on its official Twitter account, Family Bank has warned social media users to steer clear.

“Dear Customer, please note that this is a fake circulation. Reach us on 0703095445 for more information on loans. Kindly be vigilant to avoid being scammed,” the bank’s tweet reads.

Dear Customer, please note that this is a fake circulation. Reach us on 0703095445 for more information on loans. Kindly be vigilant to avoid being scammed. pic.twitter.com/YutHjOvZSr

— Family Bank Limited (@FamilyBankKenya) February 7, 2023

Africa Check has previously debunked fraudulent loan offers making the rounds on Facebook.

For more help in identifying fraudsters on social media, read our guide to Facebook scams and how to spot them.

Republish our content for free

For publishers: what to do if your post is rated false

A fact-checker has rated your Facebook or Instagram post as “false”, “altered”, “partly false” or “missing context”. This could have serious consequences. What do you do?

Click on our guide for the steps you should follow.

Publishers guideAfrica Check teams up with Facebook

Africa Check is a partner in Meta's third-party fact-checking programme to help stop the spread of false information on social media.

The content we rate as “false” will be downgraded on Facebook and Instagram. This means fewer people will see it.

You can also help identify false information on Facebook. This guide explains how.

Add new comment