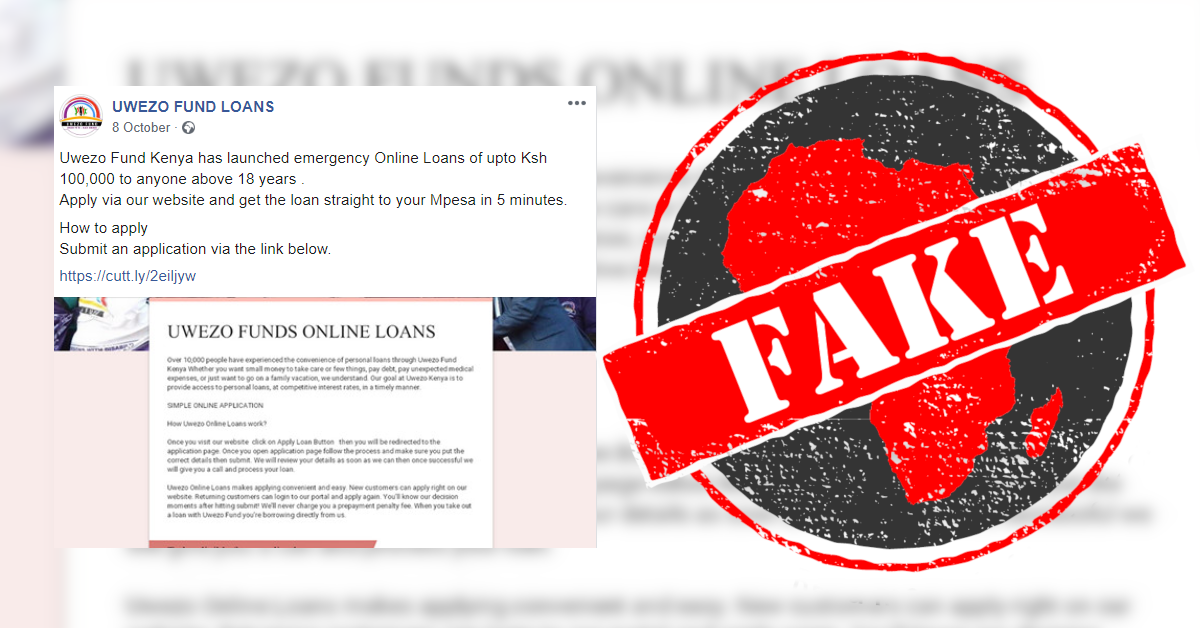

A scam Facebook page called “Uwezo Fund Loans” claims it will give Kenyans “online loans” of up to KSh100,000 – if they pay a KSh500 “application fee”.

The page was set up as recently as October 2019 and so far has only one post – offering the “loans”.

The post links to a Google form where people can apply for the money. And here’s the catch.

The “procedure of application” on the second page of the form says: “All First time(New) applicants are required to pay a fee of ksh 500.”

It then lists the “registration procedure”: “Go to your M-PESA menu. Enter phone no:0714091935 (Mr Dennis Recruitment officer). Enter the amount Ksh. 500. Your M-PESA PIN and confirm to send money.”

M-Pesa is a mobile-based money transfer app. “Pesa” is Kiswahili for “money”.

The post is similar to other scams that use the Google Forms app to con people out of money.

How to apply for a real Uwezo Fund loan

The Uwezo Fund itself is real. The Kenyan government launched it in 2013 to allow “women, youth and persons with disability access finances to promote businesses and enterprises ... thereby enhancing economic growth”.

But the fund’s application process is very different to the one given by the fake Facebook page.

People qualify for a real Uwezo Fund loan only if they are in a group or institution “registered with the department of social services, Cooperatives or the Registrar of societies”. The group or institution must include people aged 18 to 35, and/or women aged 18 and over.

To apply, people have to fill out an application form on paper, and submit it to the local Uwezo Fund office.

On its official Facebook page, the Uwezo Fund warns about scams that ask for a KSh500 “application fee” to be paid via M-Pesa.

A year ago, on 19 November 2018, the Kenya Police Service announced on Facebook that the Directorate of Criminal Investigations had arrested four men who “created a website similar to the authentic Uwezo Fund Facebook page”. The men had been defrauding victims who sent a KSh500 application fee for loan processing. – Grace Gichuhi

Republish our content for free

For publishers: what to do if your post is rated false

A fact-checker has rated your Facebook or Instagram post as “false”, “altered”, “partly false” or “missing context”. This could have serious consequences. What do you do?

Click on our guide for the steps you should follow.

Publishers guideAfrica Check teams up with Facebook

Africa Check is a partner in Meta's third-party fact-checking programme to help stop the spread of false information on social media.

The content we rate as “false” will be downgraded on Facebook and Instagram. This means fewer people will see it.

You can also help identify false information on Facebook. This guide explains how.

Add new comment