This article is more than 5 years old

- In highlighting inequality as a priority for Kenya’s growth, Chatham House said 8,300 Kenyans owned more wealth than the rest of the population.

- The figure comes from a proprietary report by private consultancy New World Wealth.

- Without information on the consultancy’s methods, it is difficult to assess whether inequality is this extreme.

“8,300 Kenyans own more wealth than the rest of the population,” the organisation wrote on its website, putting Kenya’s population at “around 48 million people”.

(Note: The latest official estimate - for 2017 - placed the country’s population at 46.6 million.)

Where did the stat come from?

Chatham House directed Africa Check to the website of anti-poverty campaign group Oxfam as the source of its statistic.

The webpage does not cite the origin of this number but in a December 2017 report the group attributed this figure to “a 2014 New World Wealth survey”.

New World Wealth is a Johannesburg-based consulting firm whose wealth reports get media attention in Kenya. Its head of research, Andrew Amoils, confirmed to Africa Check that the number was sourced from one of its reports, and sent us a copy.

Who are ‘high net-worth’ individuals?

The report said that “in 2013, there were approximately 8,300 high net-worth individuals in Kenya, with a combined wealth of US$31 billion, accounting for roughly 62% of Kenya’s total individual wealth”. Total wealth was placed at US$50 billion.

New World Wealth defines high net-worth individuals as those with US$1 million or more in net assets.

The firm produced its findings from a number of sources. It said it had a database of 120,000 high net-worth individuals, 200 of them from Kenya. Most of the names were sourced from company and director databases.

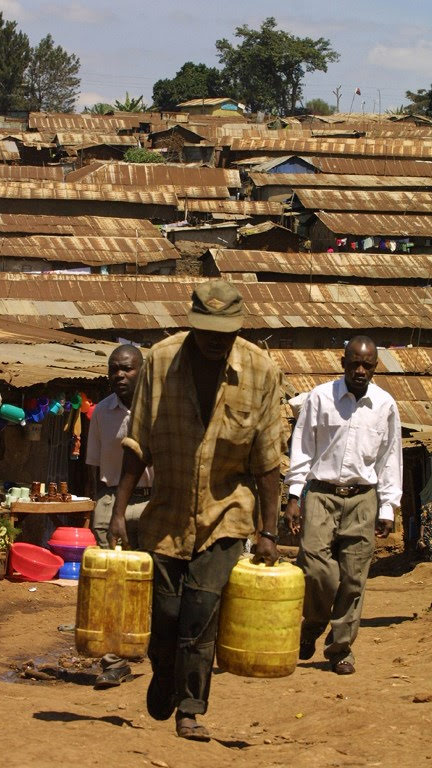

A resident of Nairobi's Kibera slum fetches water in July 2005. Photo: AFP/SIMON MAINA

It also had “profiles on luxury brands, private banks, wealth managers and family offices in each market” and “access to various luxury goods databases with a focus on prime property, yacht, art and private jet owners”.

“We use a model to calculate wealth breakdowns for each country,” Amoils said. The data fed into this model included “income distribution, GDP per capita, stock market statistics and prime property statistics in each country”.

There was a disclaimer that the findings were “based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee”. (Note: Africa Check was unable to get a publicly available copy and is prevented by licence restrictions from publishing the complimentary one.)

‘Hard to know who owns what’

The methods used to arrive at the figures published in the report are not available, making it difficult to check the claim’s accuracy.

Any assessment of the strength of an estimate would depend on knowing what data was used and the assumptions made, Prof Daniel Hruschka of the School of Human Evolution and Social Change at Arizona State University told Africa Check.

“Since the actual methodology is hidden, it's difficult to vet the claim. That would never fly in the scientific community,” Hruschka said. His work has included researching household wealth for the World Health Organisation.

According to Dr XN Iraki, a senior lecturer at the School of Business at the University of Nairobi, New World Wealth’s figure for high net-worth individuals “is such a small number” that it casts little light on the country’s general inequality.

Another difficulty in measuring wealth in Kenya is finding the real owners in records of assets.

“The use of holding companies makes it hard to know who owns what,” Iraki said. Someone’s spouse being the registered owner of an asset was another example, he said, of how difficult it was to identify the “exact owner”.

Kenyan economist Dr David Ndii said the claim “is unverifiable. I am not aware of a tried and tested method of estimating household wealth in the absence of household balance sheets.”

Top 480,000 own less than half Kenya’s wealth?

James Davies is professor at the University of Western Ontario’s economics department and an author of Credit Suisse’s Global Wealth Report and Global Wealth Databook.

While they did not have enough direct wealth data for Kenya, Davies said they used a model to relate household assets and debt to a number of variables to do with the population and economy.

“On that basis we estimate that year-end total household wealth in Kenya was US$45 billion in both 2013 and 2014. I should emphasise that this should only be regarded as a rough estimate.”

In their latest work, published in 2017, they estimated the distribution of wealth in 39 countries where there was sufficient data, Davies told Africa Check.

In 37 of these, the richest 1% of the population owned less than 50% of the country’s wealth.

“If the same were true in Kenya, the top 480,000 [using Chatham’s population estimate] would have less than half the total wealth. In that case, the top 8,300 could not have more than half of the total wealth.”

Conclusion: Weak data on assets makes it difficult to know Kenya’s wealth distribution

In April 2018 UK-based think tank Chatham House claimed that “8,300 Kenyans own more wealth than the rest of the population (around 48 million people)”.

We traced the statistic to New World Wealth, a Johannesburg-based consulting firm whose findings on high net-worth individuals in countries such as Kenya are widely reported in the media.

But experts told Africa Check that both official and private data on how Kenya’s wealth is distributed was difficult to find. And without verifiable information on the methods used by New World Wealth, it is difficult to assess the claim.

We therefore rate the claim as unproven.

Edited by Lee Mwiti

Further reading:

https://africacheck.org/factsheets/factsheet-wealth-south-africa/

https://africacheck.org/reports/pretty-much-on-the-money-worlds-80-richest-own-more-than-bottom-half-do/

Add new comment