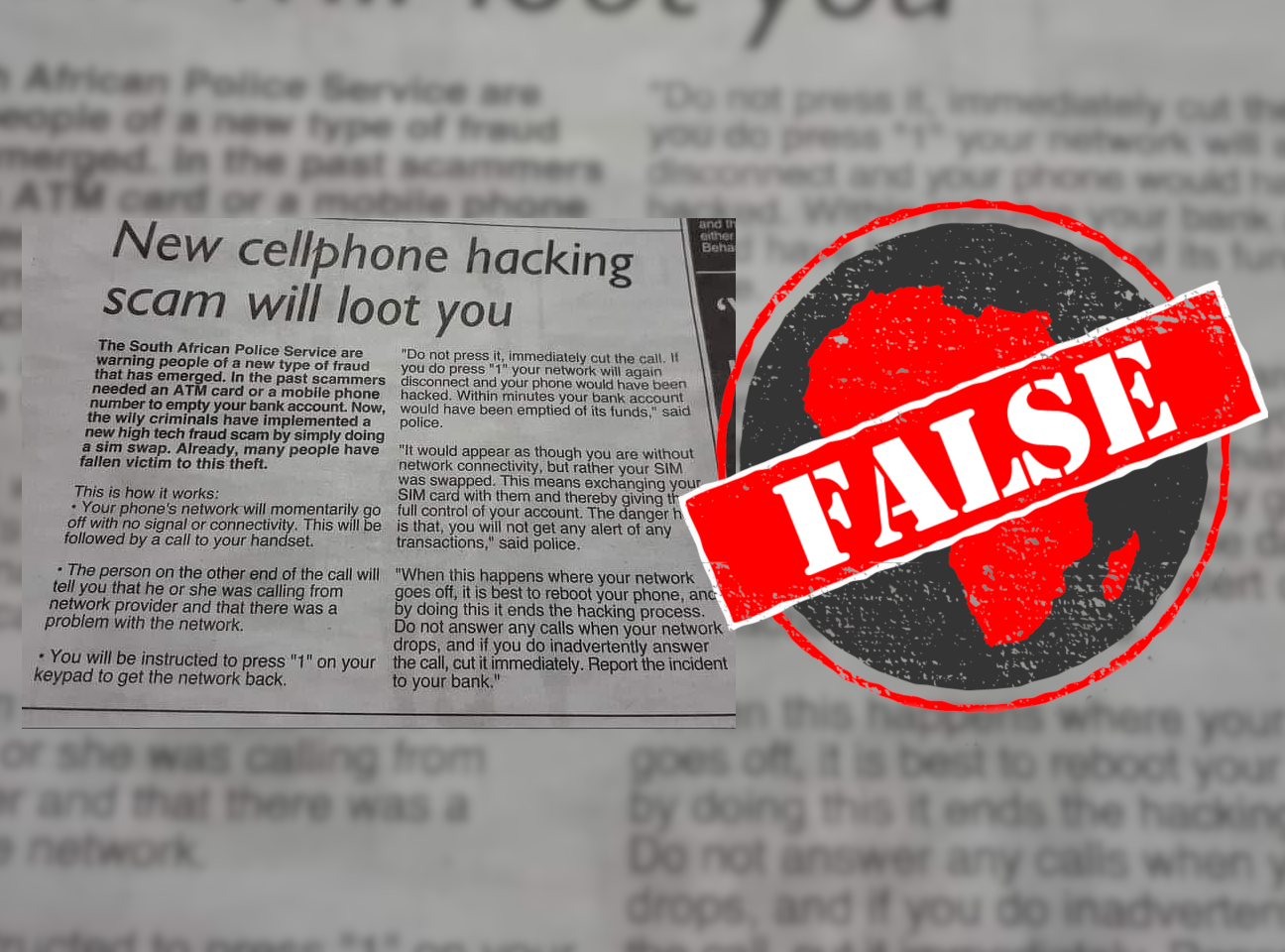

“The South African Police Service are warning people of a new type of fraud that has emerged,” reads the intro to a newspaper or magazine article, photographed and posted to Facebook in December 2020.

The photo has also been shared on Twitter.

The article claims that first "your phone's network will momentarily go off ... followed by a call to your handset", supposedly from the victim’s mobile service provider. Then “you will be instructed to press ‘1’ on your keypad to get the network back”.

The article says police have warned that if you follow the instructions, “your phone would have been hacked. Within minutes your bank account would have been emptied of its funds”.

The earliest version of the claim Africa Check could find was shared on Facebook on 23 August. But we could not find a press release from the South African Police Service warning of such a scam.

The photo shared on social media contains no information about who wrote the article or where it was published. Not being able to trace the origin of a claim is often a red flag that the information may be inaccurate or incorrect.

So is this a real scam? How does it work, and what can South Africans do to avoid it?

A number of scams involve gaining access to a victim’s cell phone number, but don’t usually take the form described in the article shared on Facebook.

As South Africa’s Standard Bank explains, SIM swap, twin SIM, and number porting scams all grant a scammer access to a victim’s cellphone number. But first the scammers usually trick the victim into giving away sensitive information like bank login details.

In some cases, scammers may call their victims and trick them into providing security details that allow the scammers to perform a SIM swap. But you won’t be asked to “press one”, and rebooting your phone as the Facebook post advises won’t prevent a SIM swap if you have already given this information away.

The usual scams the bank warns of can be performed without the victim’s knowledge. As recently as January 2020, Times Live reported that scammers could transfer a victim’s number from one network to another without any authorisation from the victim.

Gaining access to a person’s cellphone number allows scammers to receive security verification details sent to the number by SMS. Security experts estimated that in 2019 these sorts of scams cost their victims an average of between R36,000 and R43,000 each.

Standard Bank warns that people may be victims of such scams if they are suddenly unable to receive calls and SMSes, or lose network connection in an area where they usually have it.

Some scams do involve the victim being contacted by someone who is impersonating a trustworthy source such as a bank or mobile service provider.

The most similar to the scam described in the Facebook post that we could find was a scam reported by a newspaper in York, a town in the United Kingdom, in July 2019.

Local police warned readers of a “press one” scam where victims were tricked into accepting charges for an expensive connection call to a scammer posing as a trustworthy source.

This is similar to “wangiri” scams, increasingly common in Kenya. Here a person is charged for returning an expensive international call. But neither scams involve hacking a phone.

People should avoid answering calls or taking instructions from unknown numbers posing as their bank, mobile network operator, or another trusted source.

The Southern African Fraud Prevention Service (SAFPS) recommends that you always double check who you’re talking to on the phone. Ask them questions about who they are, and the company they are claiming to represent.

Most importantly, SAFPS says: “Do not share your personal, banking or credit card information with people you don't know or trust, and never give them access to your computer.”

South Africans who have been victims of a scam should report it to the SAFPS. – Keegan Leech

The photo has also been shared on Twitter.

The article claims that first "your phone's network will momentarily go off ... followed by a call to your handset", supposedly from the victim’s mobile service provider. Then “you will be instructed to press ‘1’ on your keypad to get the network back”.

The article says police have warned that if you follow the instructions, “your phone would have been hacked. Within minutes your bank account would have been emptied of its funds”.

The earliest version of the claim Africa Check could find was shared on Facebook on 23 August. But we could not find a press release from the South African Police Service warning of such a scam.

The photo shared on social media contains no information about who wrote the article or where it was published. Not being able to trace the origin of a claim is often a red flag that the information may be inaccurate or incorrect.

So is this a real scam? How does it work, and what can South Africans do to avoid it?

Claim borrows elements from several real scams

A number of scams involve gaining access to a victim’s cell phone number, but don’t usually take the form described in the article shared on Facebook.

As South Africa’s Standard Bank explains, SIM swap, twin SIM, and number porting scams all grant a scammer access to a victim’s cellphone number. But first the scammers usually trick the victim into giving away sensitive information like bank login details.

In some cases, scammers may call their victims and trick them into providing security details that allow the scammers to perform a SIM swap. But you won’t be asked to “press one”, and rebooting your phone as the Facebook post advises won’t prevent a SIM swap if you have already given this information away.

The usual scams the bank warns of can be performed without the victim’s knowledge. As recently as January 2020, Times Live reported that scammers could transfer a victim’s number from one network to another without any authorisation from the victim.

Gaining access to a person’s cellphone number allows scammers to receive security verification details sent to the number by SMS. Security experts estimated that in 2019 these sorts of scams cost their victims an average of between R36,000 and R43,000 each.

Standard Bank warns that people may be victims of such scams if they are suddenly unable to receive calls and SMSes, or lose network connection in an area where they usually have it.

Be certain who you’re talking to, don’t trust unexpected calls

Some scams do involve the victim being contacted by someone who is impersonating a trustworthy source such as a bank or mobile service provider.

The most similar to the scam described in the Facebook post that we could find was a scam reported by a newspaper in York, a town in the United Kingdom, in July 2019.

Local police warned readers of a “press one” scam where victims were tricked into accepting charges for an expensive connection call to a scammer posing as a trustworthy source.

This is similar to “wangiri” scams, increasingly common in Kenya. Here a person is charged for returning an expensive international call. But neither scams involve hacking a phone.

People should avoid answering calls or taking instructions from unknown numbers posing as their bank, mobile network operator, or another trusted source.

The Southern African Fraud Prevention Service (SAFPS) recommends that you always double check who you’re talking to on the phone. Ask them questions about who they are, and the company they are claiming to represent.

Most importantly, SAFPS says: “Do not share your personal, banking or credit card information with people you don't know or trust, and never give them access to your computer.”

South Africans who have been victims of a scam should report it to the SAFPS. – Keegan Leech

Republish our content for free

For publishers: what to do if your post is rated false

A fact-checker has rated your Facebook or Instagram post as “false”, “altered”, “partly false” or “missing context”. This could have serious consequences. What do you do?

Click on our guide for the steps you should follow.

Publishers guideAfrica Check teams up with Facebook

Africa Check is a partner in Meta's third-party fact-checking programme to help stop the spread of false information on social media.

The content we rate as “false” will be downgraded on Facebook and Instagram. This means fewer people will see it.

You can also help identify false information on Facebook. This guide explains how.

Add new comment