IN SHORT: Digital credit providers are a favourite of many Kenyans looking for quick loans. But they should be wary of scammers who have infiltrated the market by posing as lenders.

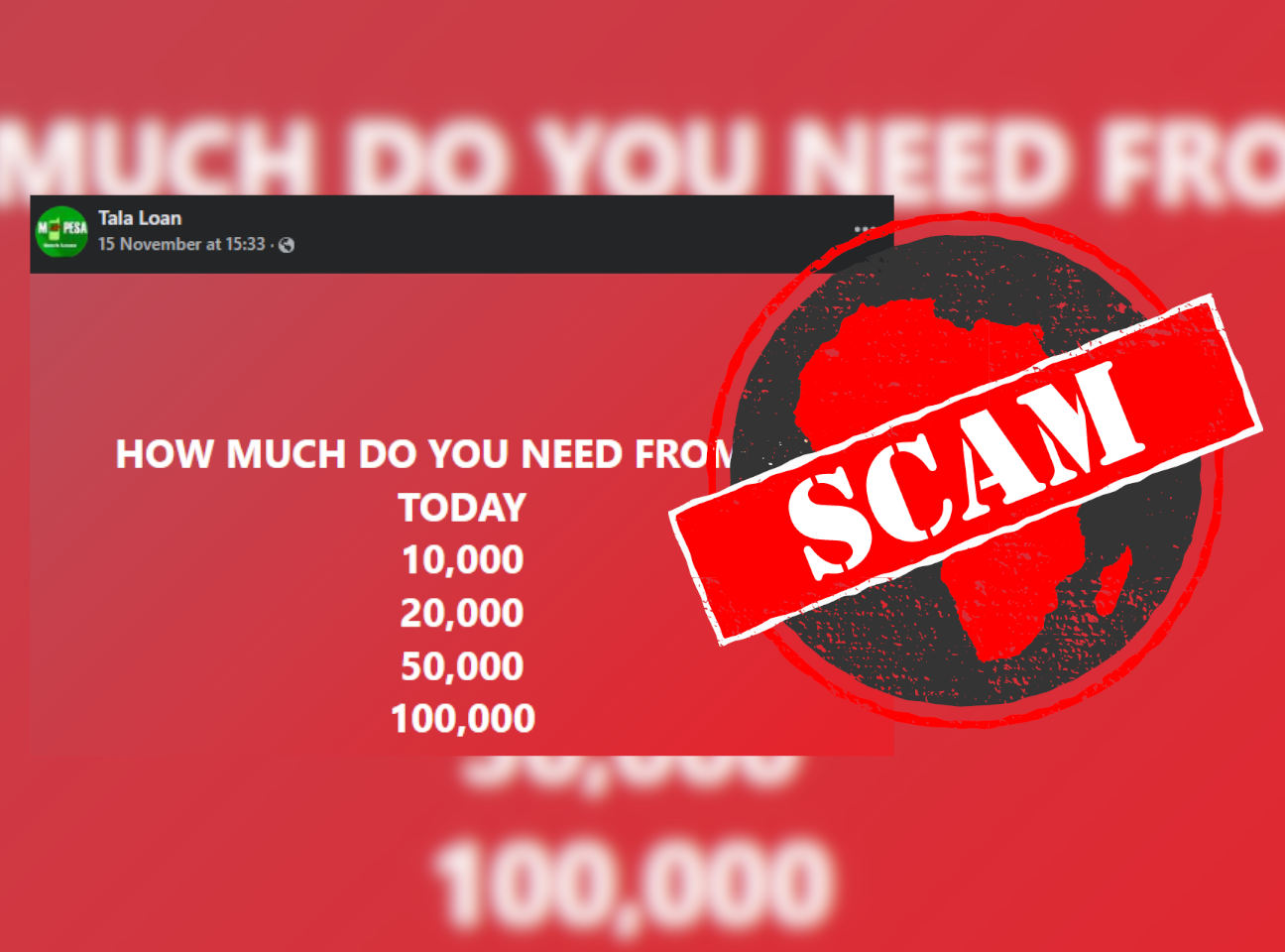

The Facebook accounts Tala Loan, Tala Loan, Tala Loan and Tala Loan Kenya's are offering quick loans to Kenyans on Facebook.

The Facebook accounts identify themselves as Tala, a well-known digital credit provider operating in Kenya, India, Mexico and the Philippines. Some even use the company’s graphics.

Perhaps in a bid to entice users, the accounts use images of wads of cash in their adverts and promise to pay out within minutes.

The accounts frequently post on Facebook groups with thousands of members.

Their posts appear on different dates here, here, here, here, here, here, here, here, here, here, here and here.

But are these accounts and their offers to be trusted? We checked.

Beware of imposter accounts

A reputable company is expected to have well-written copy, professionally produced graphics and a website or app where customers can apply for loans.

But these accounts don’t link to any website or app. They rely on blurry images to advertise the loan offers. In addition, their posts are poorly written and repeatedly posted to public Facebook groups. This is a red flag.

The official Tala Facebook page is verified and has over 799,000 followers. It can also be accessed through the company’s website www.tala.co.

To access Tala loans, a customer must download the company’s app on a smartphone and complete an application process. Based on the information provided by the applicant, a credit limit is set and the loan is either approved or declined. If approved, the loan is disbursed through a mobile money service.

Tala loans are not given randomly through WhatsApp or Facebook’s instant messaging platform Messenger. Asking users to reach out privately is likely an attempt to scam them.

The Facebook accounts are fake and their loan offers are a scam.

Republish our content for free

For publishers: what to do if your post is rated false

A fact-checker has rated your Facebook or Instagram post as “false”, “altered”, “partly false” or “missing context”. This could have serious consequences. What do you do?

Click on our guide for the steps you should follow.

Publishers guideAfrica Check teams up with Facebook

Africa Check is a partner in Meta's third-party fact-checking programme to help stop the spread of false information on social media.

The content we rate as “false” will be downgraded on Facebook and Instagram. This means fewer people will see it.

You can also help identify false information on Facebook. This guide explains how.

Add new comment