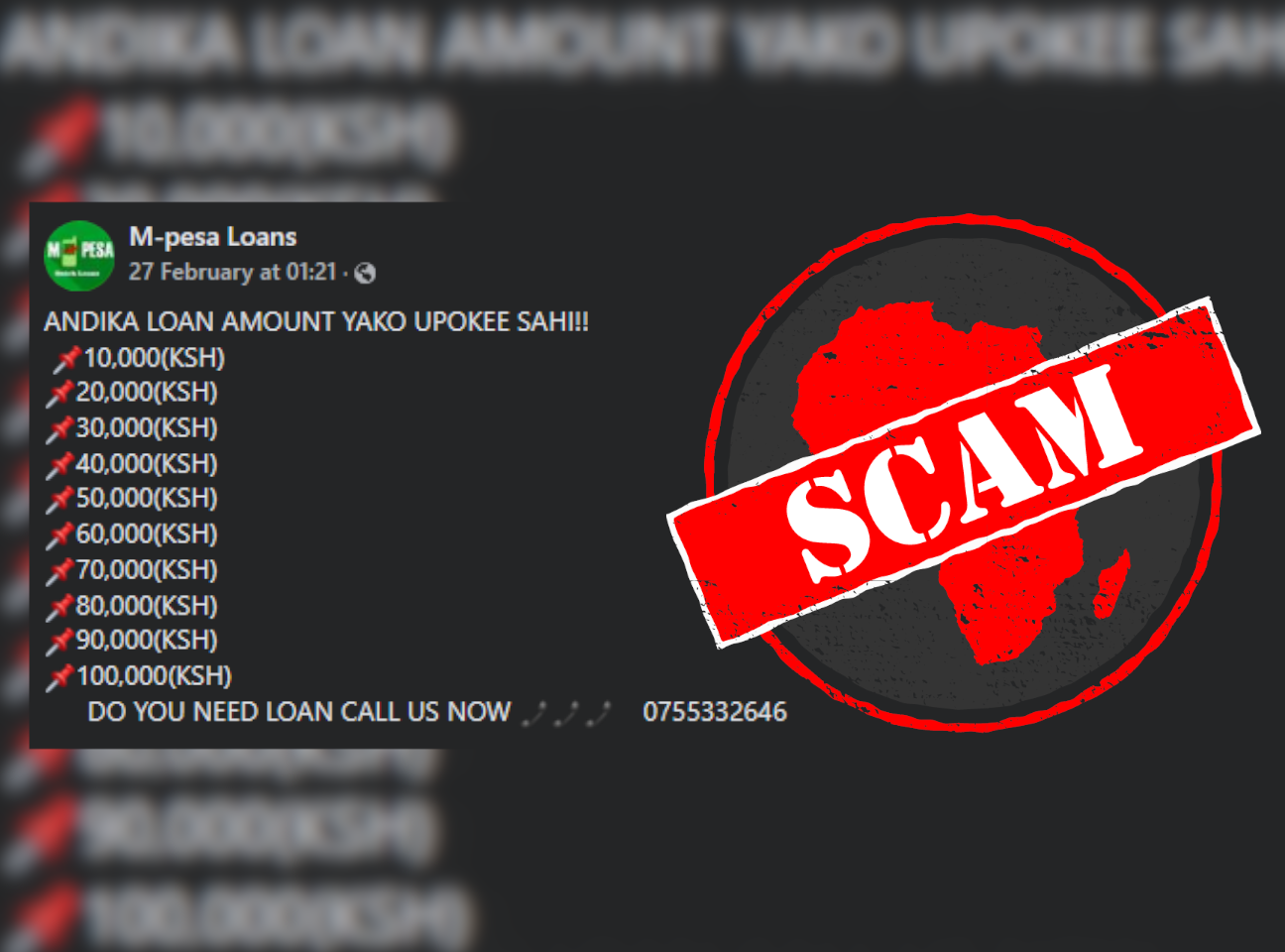

IN SHORT: The number of new Facebook pages and accounts offering quick loans on Facebook is growing. Unfortunately, not all offers are genuine and some pages may be out to scam you. Be on the lookout for this Facebook page that offers non-existent loans for a fee.

The Facebook page M-pesa Loans claims to be giving out loans to Kenyans on Facebook.

It claims that users can access up to KSh100,000 (about US$694) “in 3 minutes” and would only need to send their M-Pesa numbers. M-Pesa is a mobile financial service by Safaricom, Kenya’s largest telecoms company.

The page’s adverts feature images of wads of cash, perhaps to lure users. Some users have flooded the comments section asking for loans of various amounts.

The offers have been posted here, here, here, here and here.

But are the loan offers and the page legit? We checked.

‘Pay KSh250 fee’

The ads are poorly punctuated, repeated and not linked to any website. Genuine financial institutions have well-written adverts that are unique but send the same messages. They also have websites or apps where customers can transact and make enquiries.

The page also relies on unbranded graphics to advertise the loans. Reputable institutions tend to have professionally designed graphics that use the company’s logo and colours. This helps to identify them as legitimate businesses.

We contacted the page on Facebook and asked for a loan. The page’s operator asked for our mobile number and called us to say that we qualified for the loan. He did not ask our name, but offered the loan anyway. This is suspicious.

He also told us that we had to pay KSh250 as a “fee for creating our account” before we could access the loan. This is a red flag as financial institutions provide a platform for customers to create their accounts for free.

The page is fake and its loan offers are a scam. Read our guide on how to spot Facebook scams here.

Republish our content for free

For publishers: what to do if your post is rated false

A fact-checker has rated your Facebook or Instagram post as “false”, “altered”, “partly false” or “missing context”. This could have serious consequences. What do you do?

Click on our guide for the steps you should follow.

Publishers guideAfrica Check teams up with Facebook

Africa Check is a partner in Meta's third-party fact-checking programme to help stop the spread of false information on social media.

The content we rate as “false” will be downgraded on Facebook and Instagram. This means fewer people will see it.

You can also help identify false information on Facebook. This guide explains how.

Add new comment