IN SHORT: Scammers often use the names of well-known financial institutions to defraud the unsuspecting public. This account, which claims to be from a financial institution in Kenya, should be ignored.

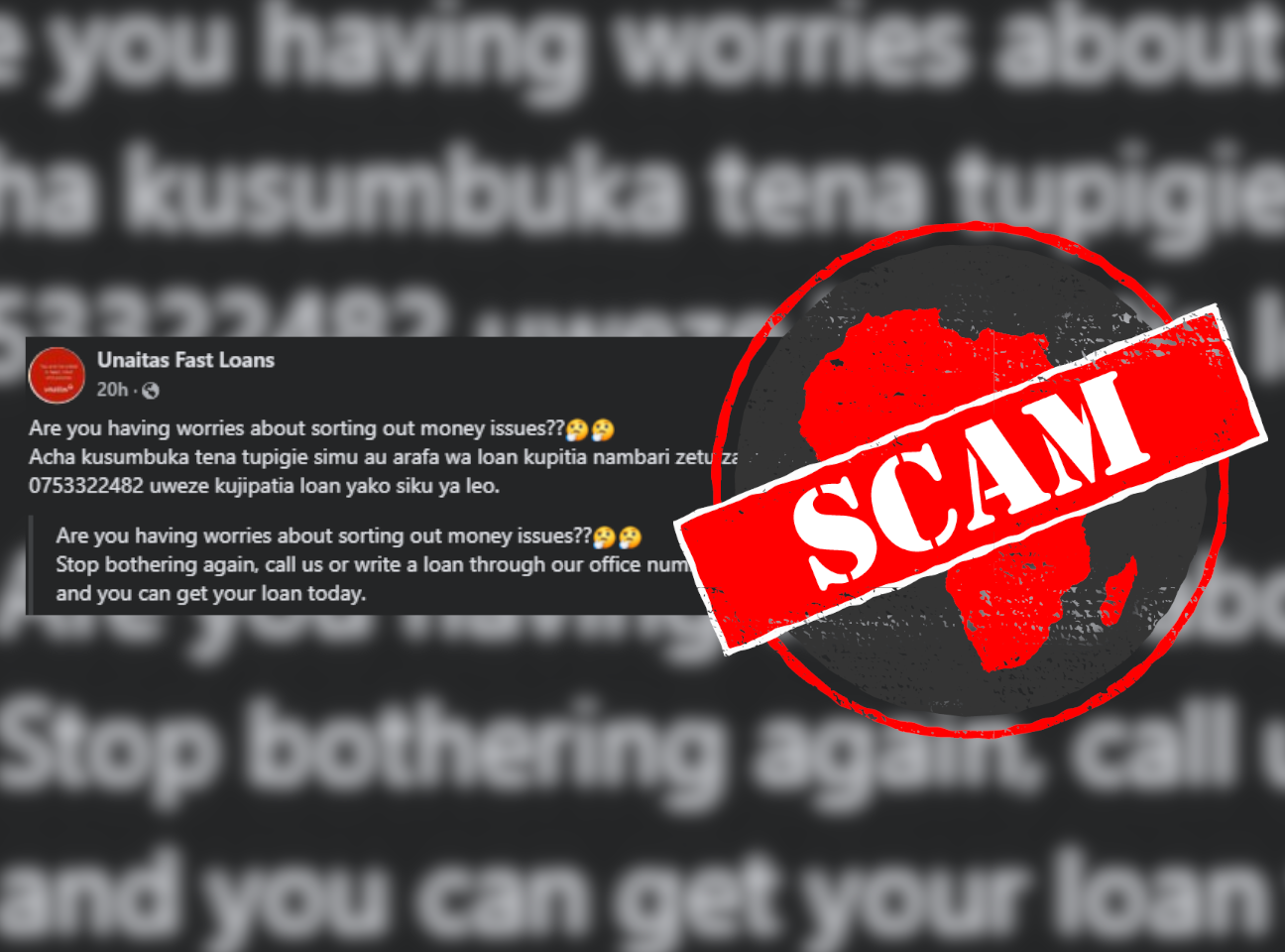

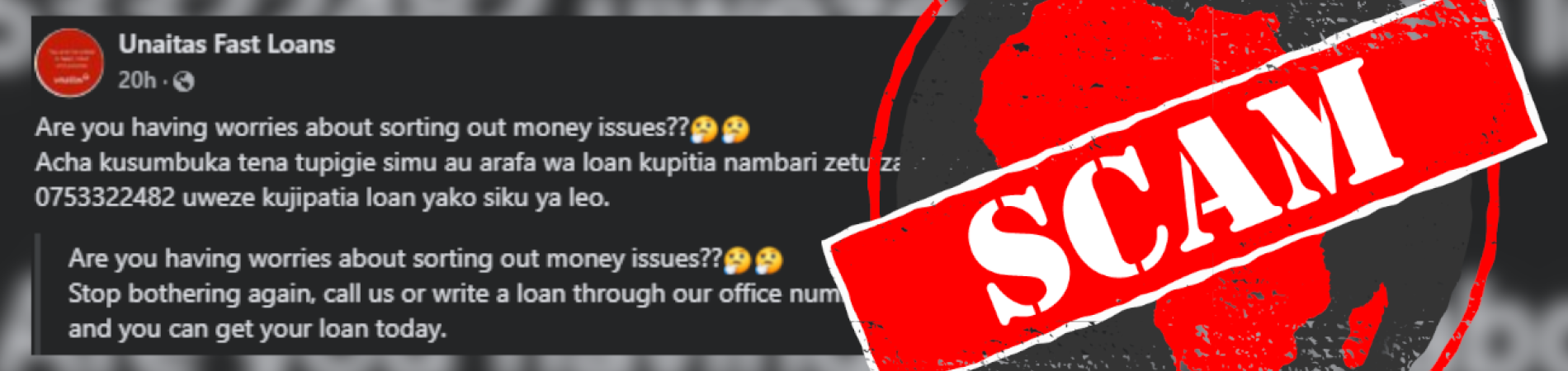

The Facebook account Unaitas Fast Loans offers Kenyans instant loans of up to KSh100,000 (US$655).

The account uses the name and logo of Unaitas, a financial institution in Kenya.

“Are you having worries about sorting out money issues??Acha kusumbuka tena tupigie simu au arafa wa loan kupitia nambari zetu za ofisi ambayo ni 0753322482 uweze kujipatia loan yako siku ya leo,” one of its posts reads.

The mix of English and Kiswahili translates as: “Are you having worries about sorting out money issues? Do not worry anymore. Call or write us a message for a loan through our office number, which is 075 332 2482, and you can get your loan today.”

The offers have been posted on the account’s own timelines as well as on Facebook groups here, here, here, here, here, here, here, here, here, here, here and here.

But are the loan offers to be trusted? We checked.

Imposter account

We noticed that the ads were poorly written, with odd punctuation and some letters randomly capitalised. This is a sign they are not from a trusted source.

While established financial institutions that lend would normally have well-functioning websites or apps where customers could apply and engage further, this account has neither. Instead, it provides a phone number where users are asked to call or text. This is another red flag.

We messaged the phone number listed in the ads and were told that any loan amount could only be accessed after paying a “registration fee” of KSh422. This is usually a trick to get users to send money, without ever receiving a loan.

None of the loan offers have been advertised on the verified Unaitas Facebook page.

The Facebook account is fake and its offers are scams. To help protect yourself from such scams, read our guide on how to spot them here.

Republish our content for free

For publishers: what to do if your post is rated false

A fact-checker has rated your Facebook or Instagram post as “false”, “altered”, “partly false” or “missing context”. This could have serious consequences. What do you do?

Click on our guide for the steps you should follow.

Publishers guideAfrica Check teams up with Facebook

Africa Check is a partner in Meta's third-party fact-checking programme to help stop the spread of false information on social media.

The content we rate as “false” will be downgraded on Facebook and Instagram. This means fewer people will see it.

You can also help identify false information on Facebook. This guide explains how.

Add new comment