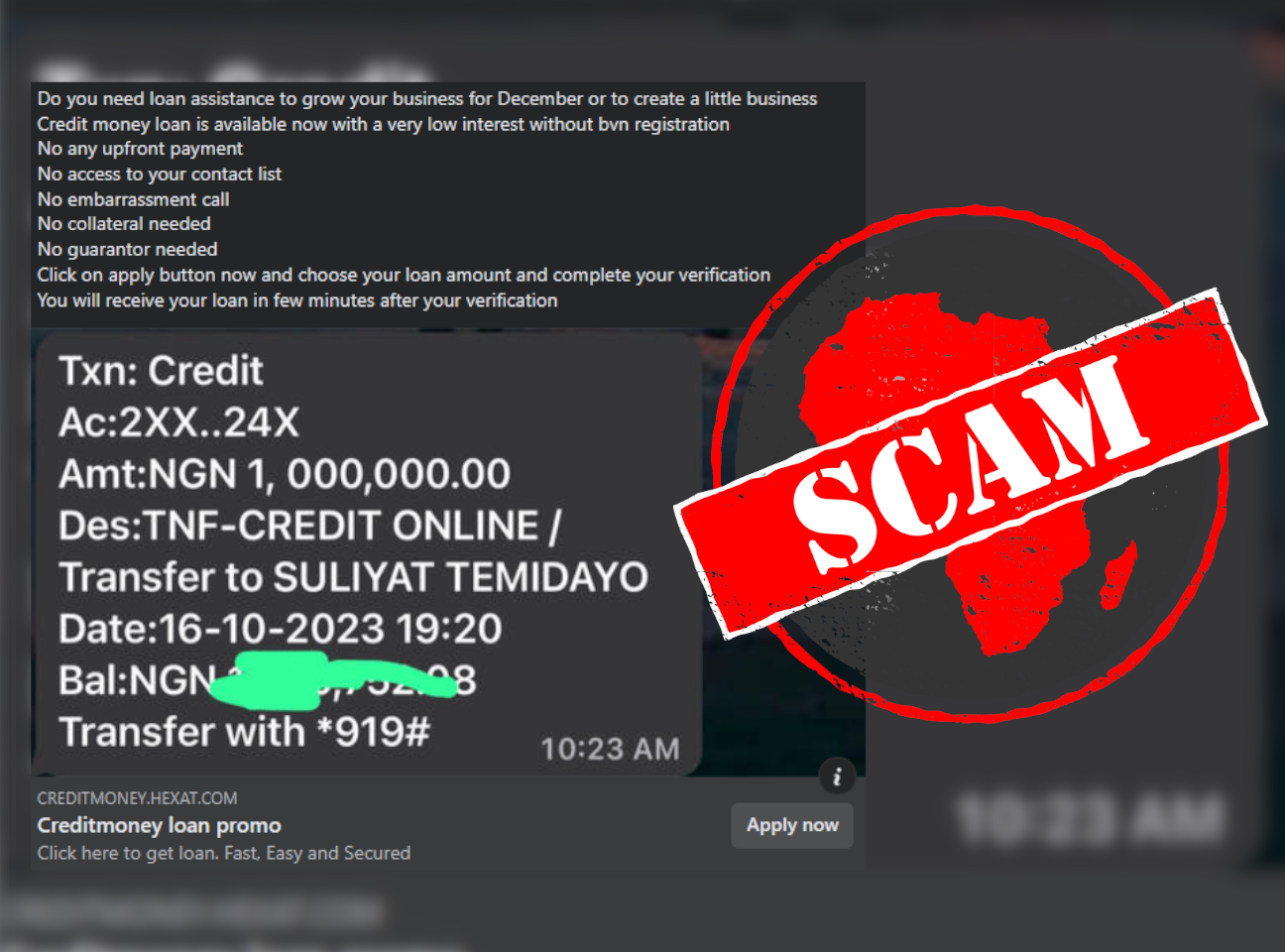

IN SHORT: Posts on Facebook are sharing links to a platform supposed to be offering loans to Nigerians with no pre-conditions. But beware – this is just another attempt to deceive the unsuspecting.

Users on Facebook are posting a link to a website that apparently offers “loan assistance to grow your business for December or to create a little business”.

One of the posts, which has received over 100 comments, reads: “Credit money loan is available now with a very low interest without BVN registration. No upfront payment. No access to your contact list. No embarrassment call. No collateral is needed. No guarantor needed.”

The bank verification number (BVN) is an 11-digit unique identifier introduced to protect banking transactions from fraud and as a form of Know Your Customer or identity verification.

The link was also posted here and here.

But is this platform legit? We checked.

Page links to a malicious website

The link clicks through to a registration page, which says: “Get the financial support you need. We are delivering, Elevating people from poverty. Trustloan is used by over 500,000 Nigerians”.

We clicked on the “APPLY” button and selected the “student loan” package, ranging from N10,000 to N200,000.

At this point, the URL changed from “creditmoney.hexat.com/?” to “trustloan.store/Japply.php”. This was already suspicious but the page also asked for our bank details, which was another big red flag.

We filled in fake bank details and this allowed us to click through to the next page. Here we were asked for the 16-digit number on our debit card, the card verification value, or CVV, which is a three-digit number used for verification purposes when making an online purchase, the personal identification number (PIN) for the card and the name on the card.

These details would allow anyone to make payments using our card. Revealing your CVV to a third party can put your bank account at risk as well as expose you to fraudulent activities.

At this point we again filled in wrong numbers and were told that our card had been rejected.

Nigerian banks like Guaranty Trust Bank, Access Bank and others have warned bank users not to disclose their details online as it exposes them to scams.

In 2023, Nigeria’s Federal Competition and Consumer Protection Commission also warned Nigerians about using unregistered digital money lenders, especially those asking them to divulge personal and sensitive banking information.

The commission said this was against its 2022 Limited Interim Regulatory/Registration Framework and Guidelines for Digital Lending. It asked members of the public to report such loan platforms.

To prevent yourself from being a victim of loan scams, read our guide.

Republish our content for free

For publishers: what to do if your post is rated false

A fact-checker has rated your Facebook or Instagram post as “false”, “altered”, “partly false” or “missing context”. This could have serious consequences. What do you do?

Click on our guide for the steps you should follow.

Publishers guideAfrica Check teams up with Facebook

Africa Check is a partner in Meta's third-party fact-checking programme to help stop the spread of false information on social media.

The content we rate as “false” will be downgraded on Facebook and Instagram. This means fewer people will see it.

You can also help identify false information on Facebook. This guide explains how.

Add new comment