IN SHORT: Viral social media posts claim that the Central Bank of Nigeria is giving out 500,000 naira cash grants to Nigerians. But this is yet another scam.

Posts on Facebook claim that the Central Bank of Nigeria (CBN) is giving out N500,000 (US$550) in cash to Nigerians, as a “palliative loan” for 2024.

A link attached to the posts directs users to a supposed application portal. In the comment section, some Facebook users have shown interest with comments like “I’m interested” and “How can I apply”.

The link preview in the post shows a photo of Nigerian president Bola Tinubu and text that reads “N500, 000” and “No BVN required!!”.

A bank verification number, or BVN, is a biometric identification system introduced by the CBN and meant to curb fraud.

We found similar Facebook posts here, here, here, here and here. But how true is this claim? Here’s what we found.

Beware of false messages not from the CBN

The link directs to a blog that gives updates on visa sponsorship and job opportunities.

The CBN is responsible for regulating money and prices, issuing legal tender currency and promoting a sound financial system in Nigeria. The Bank also acts as a licensing authority and registers Nigerian banks and other financial institutions.

In 2020 the central bank took to X, the social media platform then known as Twitter, tweeting “Beware of Fraudulent Loan offers, Investment Schemes” and linking to a “disclaimer” warning Nigerians of "fraudulent messages and videos in social media circles"

In 2022, CBN posted a video with a similar warning against scams: “People who have fallen victim to scams and frauds where they receive calls from fraudsters posing as their bank account managers or staff of the CBN, do not be their next victim. Stay cautious and protect your bank security information at all times.”

The video told people not to disclose their BVN, card verification number or any other important information.

In January 2024, the CBN also disclosed through Access Bank that it had stopped giving out loans.

In a circular reported by Punch newspaper, the bank said: “Accordingly, the CBN would be moving into more limited policy advisory roles that support economic growth. In consideration of the above, the CBN wishes to inform you that it has stopped accepting new loan applications for processing under any of its existing intervention programs and schemes”.

Africa Check also investigated whether the Nigerian government had launched a 500,000 naira cash grant or loan in 2024 and came up empty. We found no evidence that the Central Bank of Nigeria was offering any loan services or giving out cash.

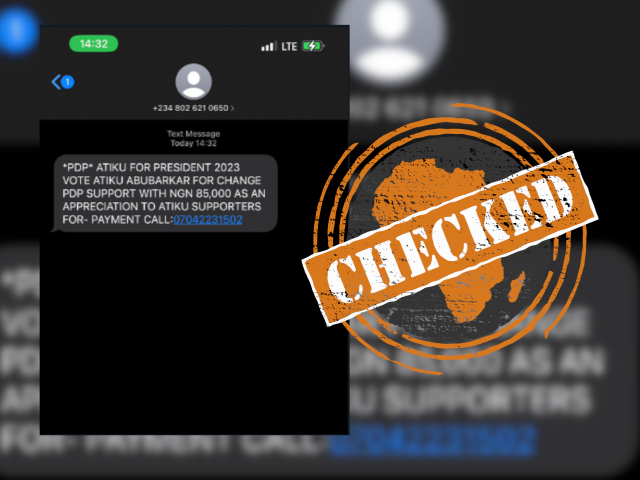

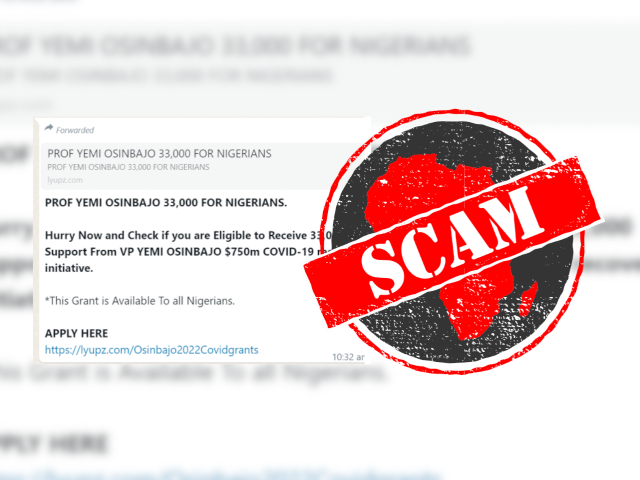

Africa Check has previously debunked similar claims here, here, here and here. For more, read our guide to spotting investment scams on Facebook.

Republish our content for free

For publishers: what to do if your post is rated false

A fact-checker has rated your Facebook or Instagram post as “false”, “altered”, “partly false” or “missing context”. This could have serious consequences. What do you do?

Click on our guide for the steps you should follow.

Publishers guideAfrica Check teams up with Facebook

Africa Check is a partner in Meta's third-party fact-checking programme to help stop the spread of false information on social media.

The content we rate as “false” will be downgraded on Facebook and Instagram. This means fewer people will see it.

You can also help identify false information on Facebook. This guide explains how.

Add new comment