IN SHORT: The Nigeria Inter-Bank Settlement System has delisted some non-deposit-taking financial institutions, but online claims that a microfinance bank and some popular mobile money operators will be affected are false.

Claims have been made on social media that the Nigerian government will outlaw “online banking systems”, affecting some popular services.

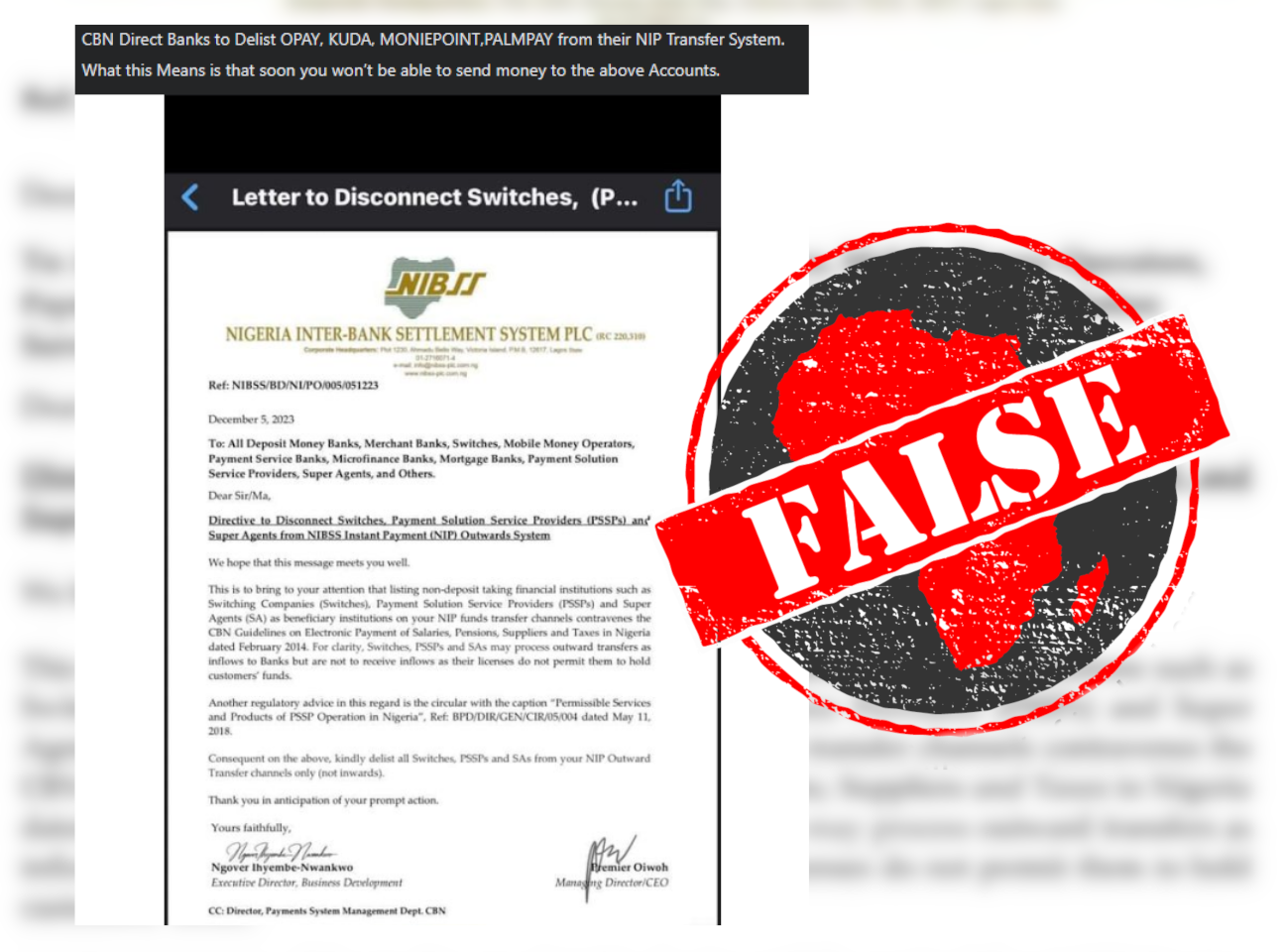

One such claim on Facebook reads: “CBN Direct Banks to Delist OPAY, KUDA, MONIEPOINT,PALMPAY from their NIP Transfer System. What this Means is that soon you won’t be able to send money to the above Accounts.”

Opay, Moniepoint, Kuda and Palmpay are companies in Nigeria’s financial ecosystem, providing services such as payment processing.

Opay, Moniepoint and Palmpay became very popular with Nigerians in the wake of the currency shortage that followed the chaotic redesign of naira notes in February 2023.

Registration on these platforms was also easy, as users could simply register online with their phone numbers, and were charged little or nothing for transactions. This brought the platforms millions of users and a surge in their monthly transaction value.

The claims come on the back of an announcement by the Nigeria Inter-Bank Settlement System. Nibss is owned by all licensed banks in Nigeria and it handles instant payments and other related services between banks.

In December 2023 Nibss said that such companies, which it described variously as payment solution service providers, switches and super agents, should not be listed on its outward payment or transfer list. This, it said, was because they were by law not allowed to take deposits.

The claims about the ban have been made a number of times on Facebook, including here, here, here, here and here.

But did Nibss delist these financial institutions, potentially affecting millions of their users in Nigeria? We checked.

Mobile money operators and microbanks not affected by Nibss change

The Nibss circular said financial institutions should “delist all Switches, Payment Solution Service Providers (PSSPs) and (Super agents) SAs” from their “NIP Outward Transfer channels only (not inwards)”.

NIP is the Nibss Instant Payments, a real-time payment service where the recipient receives funds immediately.

But Opay, Palmpay and Moniepoint are listed on the Central Bank of Nigeria website as mobile money operators, while Kuda is a microfinance bank.

These categories are different from those listed in the Nibss communication.

Mobile money operators and microfinance banks are exempted because their licences allow them to hold customer funds.

In contrast, switches, PSSPs and SAs are not licensed to do so.

A presidential aide, Dada Olusegun, has also said the claims are fake.

Republish our content for free

For publishers: what to do if your post is rated false

A fact-checker has rated your Facebook or Instagram post as “false”, “altered”, “partly false” or “missing context”. This could have serious consequences. What do you do?

Click on our guide for the steps you should follow.

Publishers guideAfrica Check teams up with Facebook

Africa Check is a partner in Meta's third-party fact-checking programme to help stop the spread of false information on social media.

The content we rate as “false” will be downgraded on Facebook and Instagram. This means fewer people will see it.

You can also help identify false information on Facebook. This guide explains how.

Add new comment