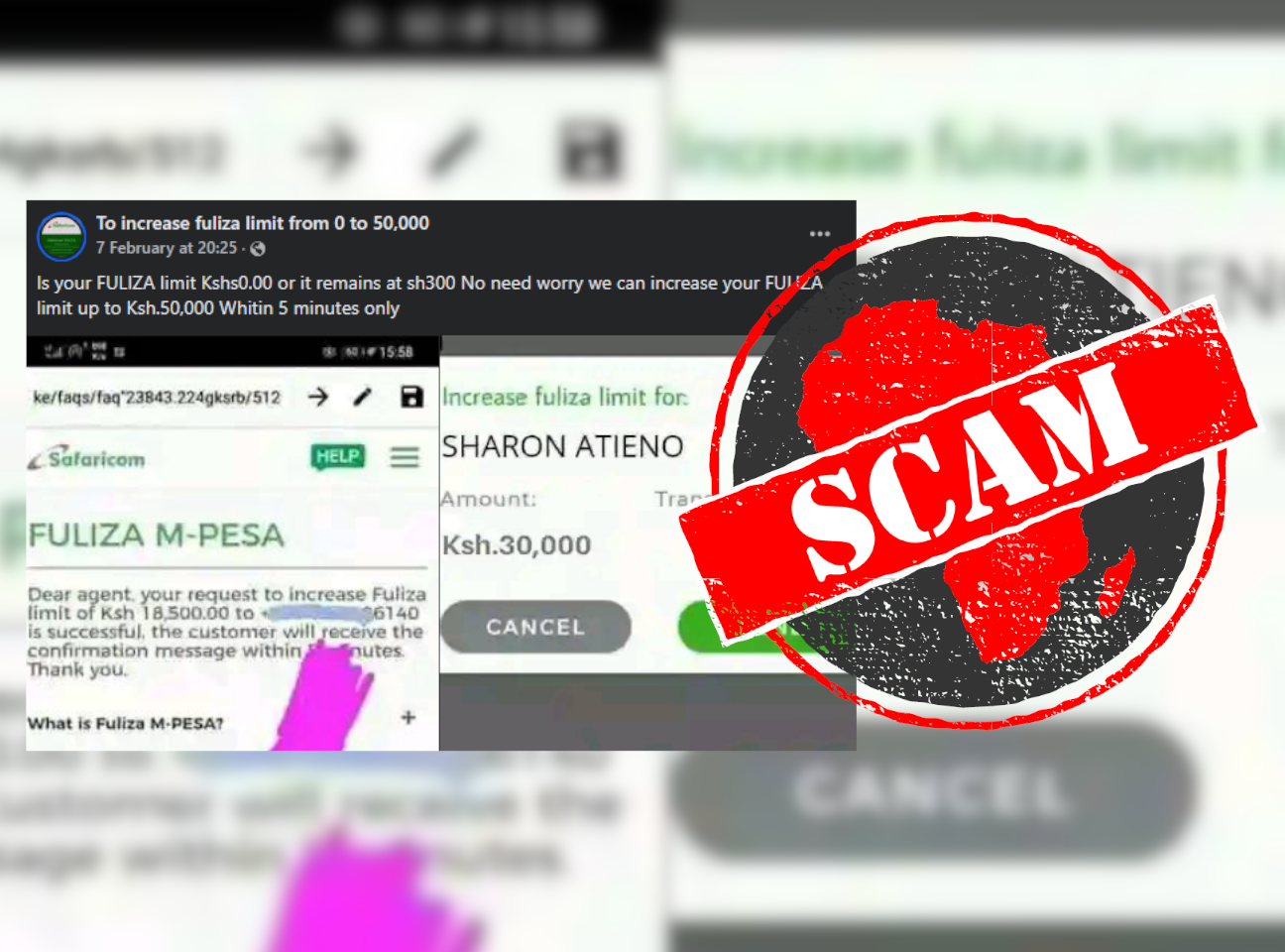

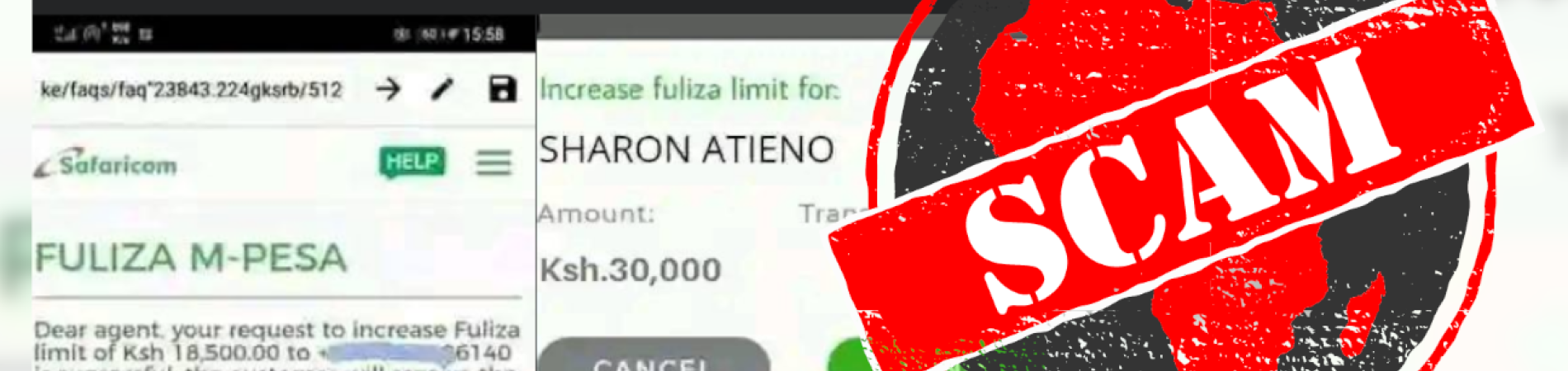

IN SHORT: A growing number of Facebook pages are offering to increase the credit limit on Kenya’s popular Fuliza overdraft service. But beware, they are all scams.

The Facebook pages Fuliza Increment loans, Fuliza Increase Limit and To increase fuliza limit from 0 to 50,000 claim they can increase the borrowing limit on Kenya’s popular Fuliza service.

Fuliza is an overdraft service run by Safaricom, Kenya’s largest telecoms company, in partnership with two of the country’s biggest banks. The service allows M-Pesa mobile money users to complete a transaction even if they don’t have enough money in their account. M-Pesa is Safaricom’s mobile money transfer and payment service.

One of the page’s posts, dated 7 February 2024, reads: “Is your FULIZA limit Kshs0.00 or it remains at sh300 No need worry we can increase your FULIZA limit up to Ksh.50,000 Whitin 5 minutes only.”

The pages have posted the offers here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here and here.

But are these pages to be trusted? We checked.

Fake pages

According to Safaricom, M-Pesa customers who registered using their national identity cards can activate Fuliza, but not all are eligible for a credit limit upon activation.

It said that those who had been on its network for less than six months would have a “zero limit”. The allocation of the limit would later be “based on their line’s activity”.

“To grow the Fuliza limit, you need to continue using Safaricom and M-PESA services and repay your Fuliza M-PESA facility on time by topping up your M-PESA account,” the company said.

So it’s misleading for the Facebook pages to claim they can increase the limit.

We also noticed that two of the pages promised to raise the Fuliza limit to KSh75,000. This is a big red flag as the company has stated that the minimum a customer can send using the Fuliza service is KSh1 and the maximum is KSh70,000.

The page’s requests for users to engage privately by sending a message could be an attempt to scam people.

All signs point to fake Facebook pages with scam offers.

Republish our content for free

For publishers: what to do if your post is rated false

A fact-checker has rated your Facebook or Instagram post as “false”, “altered”, “partly false” or “missing context”. This could have serious consequences. What do you do?

Click on our guide for the steps you should follow.

Publishers guideAfrica Check teams up with Facebook

Africa Check is a partner in Meta's third-party fact-checking programme to help stop the spread of false information on social media.

The content we rate as “false” will be downgraded on Facebook and Instagram. This means fewer people will see it.

You can also help identify false information on Facebook. This guide explains how.

Add new comment