-

As companies in Kenya are usually taxed on their profits, this often results in a lower effective tax rate for them, leading to a perception of inequality in the tax burden.

-

But experts say simply comparing personal and corporate income taxes is like comparing apples and oranges, as many other factors are at play.

-

The publication was however right that six out of 10 small businesses in Kenya have defaulted, and foreign investors have exited in droves.

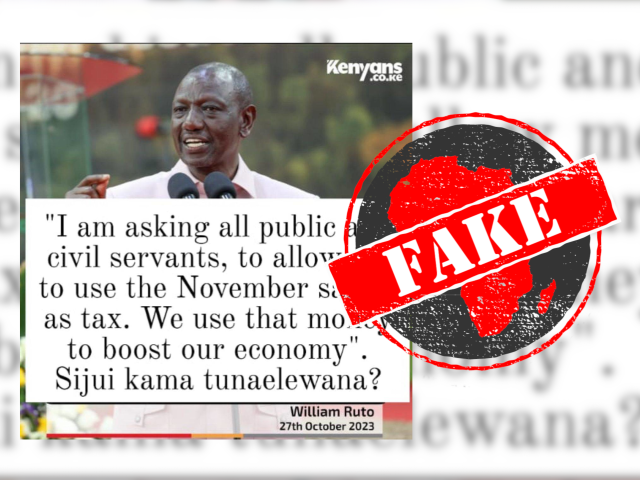

In November 2023, Kenyan political magazine the Weekly Review gave president William Ruto a failing grade for his handling of the economy.

“E for Economy” was the bold headline. The magazine is published by the newspaper with the largest circulation in the country, the Nation.

The kicker below the headline in a version of the cover that did the rounds online had more details.

It read: “A majority of Kenyans living in the hand-to-mouth informal sector pay higher personal income tax than corporate bodies. About 60% of SMEs are in default, while 42% of foreign investors have fled the NSE. The nation is in dire straits.”

SMEs are small and medium enterprises, while the NSE is the Nairobi Securities Exchange, the country’s financial marketplace.

The editor of the Weekly Review told Africa Check that this version was the authentic front page. In it, the kicker gave less detailed reasons for the poor grade, including unpopular tax policies and investors voting with their feet.

We checked the text of the full article published online (behind a paywall) and found that it contained the more detailed claims in the version being shared online.

So we took a closer look at four of these.

The paywalled article questioned why poor Kenyans who earn a living in the informal sector pay higher taxes on their personal income than companies.

The International Labour Organization defines the informal economy as workers or enterprises that are not covered, or are insufficiently covered, by official rules. This is either because the laws do not apply to them or because they do not fully comply with them.

The Institute of Economic Affairs-Kenya, an economic thinktank, says that the informal sector in Kenya is generally considered “as comprising of activities of petty traders … involved in the sale of second-hand items like clothes, shoe shining, street vendors, carpentry, vegetable selling, repair and construction work”.

In a 2021 report, the Federation of Kenya Employers defined informal enterprises as unregistered businesses.

The employers’ lobby also defined an informal worker as one who did not have a contract, written or oral, did not have paid time off or work-provided health benefits, and whose employer did not contribute to social security or health insurance.

The Kenya National Bureau of Statistics publishes annual economic surveys that include employment data.

The most recent survey found that the “informal sector …remains the main source of employment for the working population” in Kenya. It showed that of an estimated 19.1 million people in employment, 15.96 million were in the informal sector. The informal sector thus accounted for 83.6% of total employment. This figure does not include those engaged in small-scale agriculture or pastoralist activities.

By law, the basic monthly minimum wage is between KSh18,862 and KSh23,868 (US$120 and $150), depending on location. Those in urban areas are paid more than those in rural areas. Furthermore, in Kenya, any adult who spends a maximum of KSh3,252 per month in the rural areas, and KSh5,995 in urban areas, is considered poor.

But do these informal sector workers pay more income tax and non-value added tax than companies?

Perception of inequality around taxation of companies

Maurice Lugongo, a senior manager for tax and legal at Deloitte Kenya, explained the nuances of taxation in the country.

Individuals paid taxes based on their gross income, while companies paid their corporate taxes on their income after deducting various business-related expenses, he told Africa Check.

According to the Kenya Revenue Authority, personal income tax is levied on a sliding scale of between 10% and 35%, while corporate income tax is levied on profits at a flat rate of 30% for Kenyan companies and 37.5% for foreign companies.

“It may not be 100% true that [individuals] are taxed more heavily, from an income tax perspective, than corporate bodies,” Lugongo said.

For example, an individual earning up to KSh288,000 a year pays tax at 10%, while a Kenyan company pays corporate tax at 30% on profits only.

However, as companies are usually taxed on their profits, this often results in a lower effective tax rate for them, leading to a perception of inequality in the tax burden.

Put simply, comparing personal and corporate income taxes is misleading. Because of the differences in how the taxes are designed and what they're based on, it's like trying to compare apples and oranges.

Moreover, with the maximum minimum wage at KSh23,868 per month (or KSh286,416 per year), the majority of informal sector workers who do pay tax are taxed at 10%.

In addition, informal sector workers often find it difficult to pay income tax due to irregular income streams, lack of formal documentation as payments are often made in cash and off the books, and limited enforcement mechanisms. Companies, as registered business entities, don't have such loopholes.

The claim is misleading.

The Weekly Review article said that at 11% of total tax revenue, corporate taxes in Kenya are already among the lowest in the world, compared to 31 African countries, for which it gave a figure of 19%. (Note: The article incorrectly gave the percentage as a share of gross domestic product [GDP], rather than of total revenue as given in the OECD source it cited.)

It continued: “Personal income tax and taxes other than VAT (value-added tax) are higher in Kenya than the average in 31 African countries.”

The author cited his earlier article, published on 26 February 2023, which quoted revenue statistics from the African Union and the European Union. He said the figures came from the Organisation for Cooperation and Development (OECD). That first article cited the data correctly.

The OECD's Revenue Statistics in Africa 2023 document shows that Kenya's taxes amounted to 15.2% of GDP in 2021, the 15th highest of the 33 African countries surveyed.

The average ratio of tax revenue to GDP for the 33 countries was 15.6%. The World Bank says that countries should raise revenues equivalent to at least 15% of GDP to meet the basic needs of citizens and businesses.

The data also shows that in Kenya, personal income tax accounted for 22% of all taxes collected in 2021, compared to 11% for corporate tax.

So how does Kenya compare to other African countries for corporate and income tax?

Kenya among the highest for personal income

From the OECD’s global revenue statistics database, we extracted data on the two tax items as a proportion of total revenue for 32 African countries, including Kenya. Although Eswatini appears in the database, the query did not return any data. (Note: See Excel files from the database.)

The data showed that in 2021, Kenya had the ninth highest personal income tax revenue as a proportion of total revenue, at 22.1%. The countries with the highest personal income tax as a share of revenue were Lesotho (41.3%), Namibia (40.6%), Malawi and Sierra Leone (both 32.2%), and South Africa (32.1%). The lowest ratios were found in Côte d'Ivoire (0.4%), Guinea (5.9%) and Mali (6.6%).

Country among the lowest for corporate income

For corporate income as a share of total tax revenues, Kenya ranked 26th, with 11%. The highest were Equatorial Guinea (56.9%), Nigeria (35%) and Chad 32%. Kenya was among the lowest, ahead of Tunisia (7.1%), Cape Verde (8.3%), Congo (8.4%), Uganda (8.8%) and Guinea (9.4%).

Kenya's 11% corporate tax rate is also lower than the 19% average for the African countries surveyed, as the author notes elsewhere in the article.

The data supports the claim.

In September 2023, mainstream newspapers in Kenya reported that 60% of micro and small enterprises (MSEs) had defaulted on loans.

The publications cited an August 2023 survey by the Central Bank of Kenya, the Kenya National Bureau of Statistics and non-profit the Financial Sector Deepening Trust.

The survey defined micro-enterprises as those with fewer than 10 employees and an annual turnover of less than KSh1 million. Small enterprises were those with between 10 and 50 employees and an annual turnover of between KSh1 million and KSh5 million.

The survey found that 60.7% of these businesses had defaulted on their loans by June 2023, up from 42.8% in October 2022, Ruto's first full month as Kenyan president.

The claim is supported by the most recent credible data.

The Weekly Review cited the central bank’s most recent financial stability report, published in September 2023.

“Foreign investors at the Nairobi Securities Exchange (NSE) continued to offload their portfolio holding,” the report said. It added that investor flight could partly explain “exchange rate depreciations as foreign investors continue to exit or stay away from the NSE, thus weakening it further”.

For the exact figures, we checked with the Capital Markets Authority (CMA), which regulates the securities market. The CMA publishes quarterly statistical bulletins summarising investor profiles and numbers.

Ruto was inaugurated in September 2022. At the end of that month, the third quarter of the year, the regulator’s data showed that there were 1,095 foreign corporate investors and 13,769 foreign individual investors in the stock market – a total of 14,864.

There were also eight foreign corporate investors and 26 foreign individual investors in the bond market, making a total of 34. This brought the total number of foreign investors to 14,898 as of September 2022.

The latest report for the third quarter of 2023 shows that there were 451 foreign corporate investors and 8,170 individual corporate investors in the stock market – a total of 8,621. In the bond market, there were seven foreign corporate investors and 24 foreign individual investors. The total number of foreign investors in September 2023 was 8,652.

The number of foreign investors fell from 14,898 to 8,652, a decrease of 6,246 investors or 42% between the end of September 2022 and September 2023.

We therefore rate the claim as correct.

Add new comment